What we do

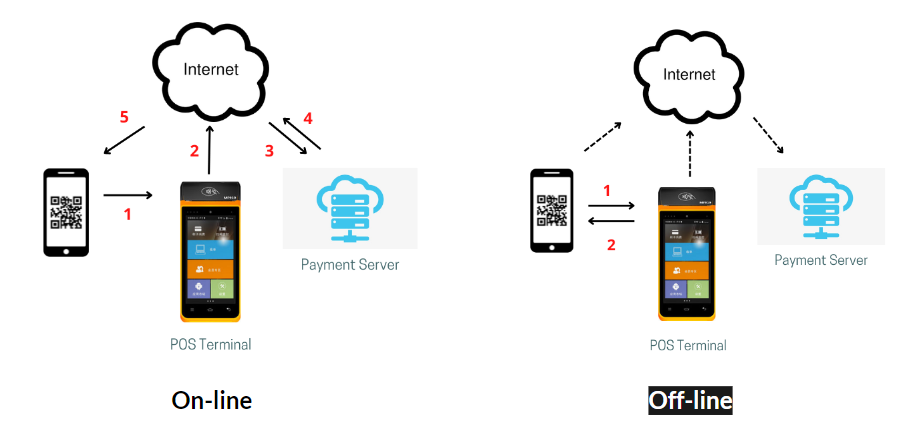

We help payment companies to enhance the operational resilience of their QR-code payment system by enabling offline capability.

Problem Statement

The future financial system, CBDC will be coming in the next few years. In order to stay competitive, operational resilience will be the key differentiation.

- One of the challenges of CBDC is that “with enhanced operational resilience of the payment system, designed with offline capability, that allows some payments to be made without internet access and can be executed during natural disasters or other large disruptions”, US Federal Reserve.

- As a replacement for M0, retail CBDC needs “to provide [resilient] cash-like payment experience, the ability to handle peak traffic as well as connectivity breaks or offline”, BIS.org.

Offline Solution

Benefits:

- Enhance operational resilience against Internet network failure, system disruption, and natural disaster

- Reduce the need for expensive payment data centers to maintain system availability and peak traffic handling

- Avoid initial payment servers investment to expand globally

- Financial inclusion: where the Internet infrastructure is poor.

- Low or zero cost of transactions

- Zero CO2 emission

To learn more, please contact us, at keith@ibonus.net